Underwrite with clarity. Retain with confidence.

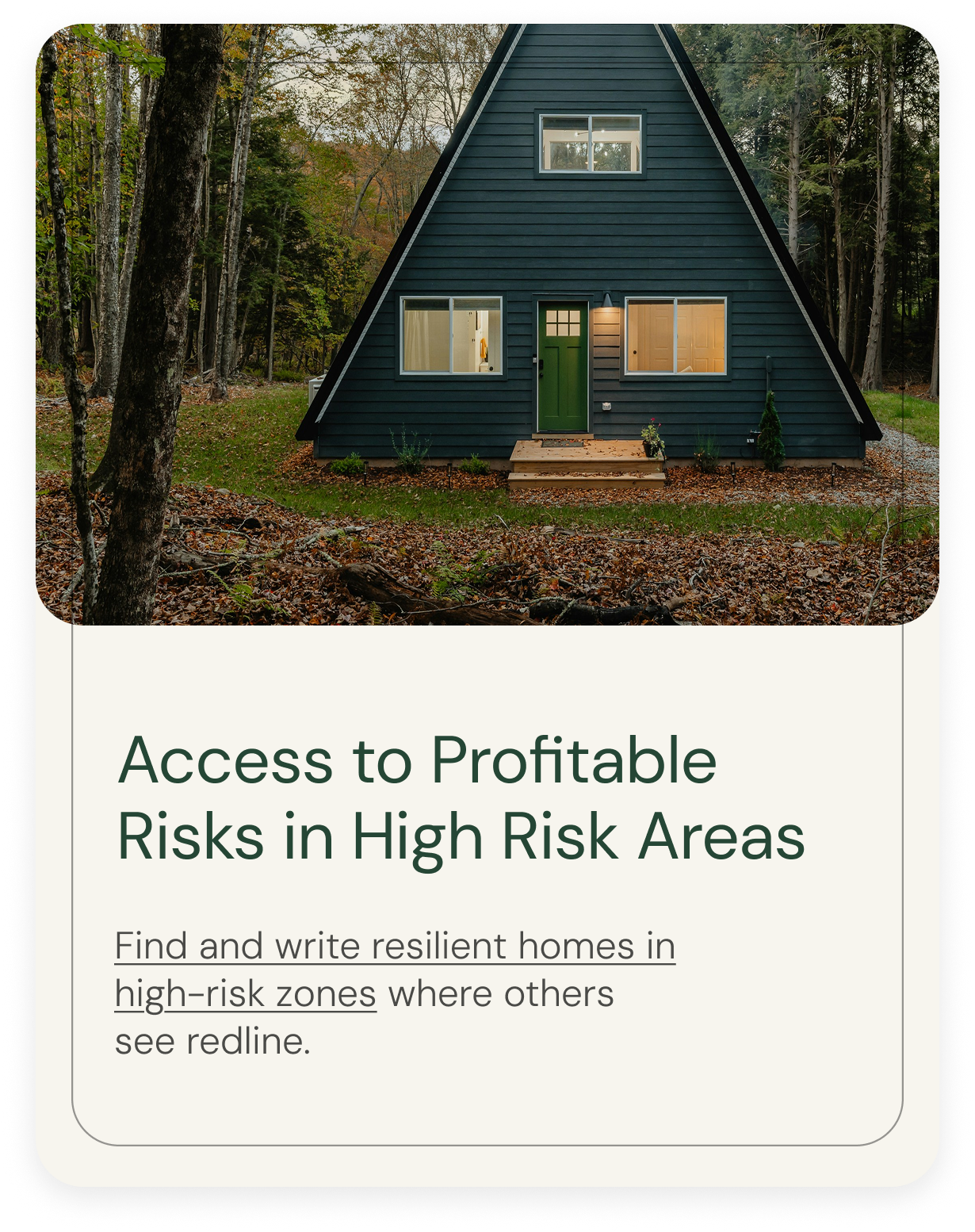

We unlock new, long-lasting business for insurers in high-risk areas previously untouched by traditional climate models.

Betting against nature is no longer profitable.

Carriers are missing out on billions of premium because we’ve never had to fully understand our property risk.

With the lack of verified property data, reliance on public providers, and rising reinsurance costs, the solution lies in partnership with our policyholders.

Natural disaster risk has changed, but how we handle it hasn’t.

Faura helps insurers find and retain profitable business in high risk areas by verifying third-party property data, all in partnership with your policyholder.

Survivability is directly linked to profitability.

Homes that are resilient to natural disaster reduce the likelihood of a loss. Faura helps you find, keep, and reward those homes.

Quantify the structural risks,

then act on it.

Want to learn more about our solutions?

Join our insurance clients who have already found millions in risk reduction with Faura tools.

Faura In the News

Faura equips your team, agents and insureds to stay ahead in the age of catastrophe.